You can receive a Mississippi tax credit by giving to Homes of Hope! Here’s how:

Watch a Step by Step Instruction Video (Click Here)

2025 MS State Tax Credit Applications (all online)

Following the steps below may allow you to take advantage of the Mississippi state tax credit that you qualify for just by giving to our ministry, as we are now designated as an ETHO and a QCO.

Step 1: Go to tap.dor.ms.gov or click here.

Step 2: Click “Apply for a Charitable Contribution Credit” and complete the application (click here to watch a video for further instructions).

Step 3: Receive your approval letter from MS DOR (usually within 10 days).

Step 4: Make your donation to Homes of Hope for Children: online at homesofhope.ms/donate or by mail (Homes of Hope for Children, PO Box 18496, Hattiesburg, MS 39404).

Step 5: Receive your donation receipt from Homes of Hope for Children.

Step 6: Submit your donation receipt to MS DOR: online at tap.dor.ms.gov (scroll down to “Upload Documents” and click “Upload Requested Documentation”) or by mail (MS Department of Revenue, P.O. Box 22828, Jackson, MS 39225).

Note: If you have already given a donation this year to Homes of Hope for Children and would like to receive a tax credit, simply follow steps “1”, “2”, “3”, & “6”.

Please contact us at smciver@homesofhope.ms or 769.456.7021 for more information.

Important: Always talk to your tax advisor before making any decisions regarding your tax liability. Please let your tax advisor know you are interested in taking advantage of the tax credit allowed by the Children’s Promise Act Eligible Transitional Home Organization Act §27-7-22.39 of the Mississippi Code Annotated.

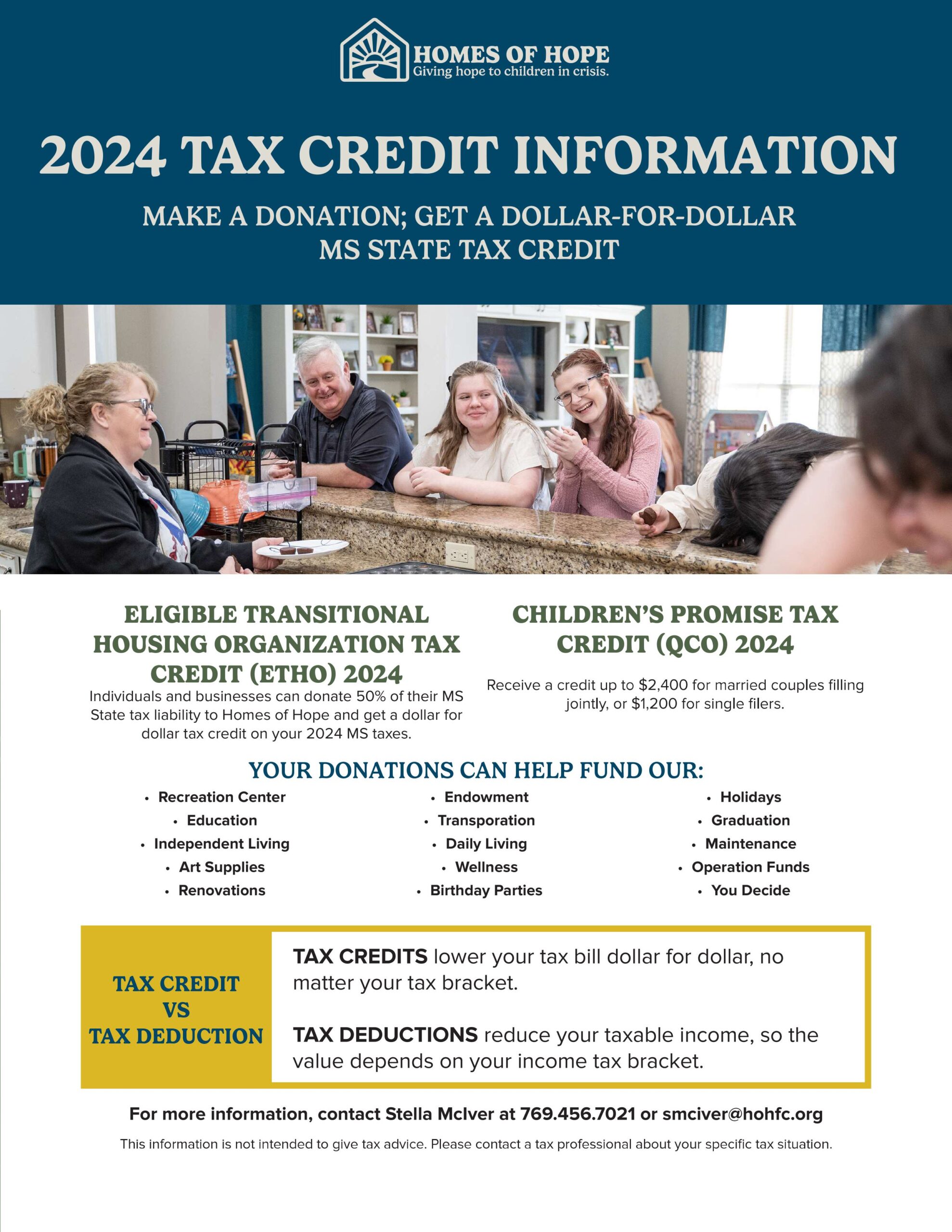

Homes of Hope for Children is a:

- Qualified Charitable Organization (QCO) — Children’s Promise Tax Credit

- Eligible Transitional Housing Organization (ETHO) — NEW (we qualified for this in mid-2024)

2025 Applications for Allocations:

Eligible Transitional Living Home Organizations (ETHO)

Thanks to recent legislation, a wonderful opportunity has emerged for Homes of Hope for Children for 2025. We are delighted to inform you that our organization has now been designated as an “Eligible Transitional Home Organization.” This designation enables us to accept cash contributions, resulting in significant benefits for both businesses and individuals in terms of tax credits.

Mississippi businesses have the chance to contribute up to $2,500,000 to our organization, while individual Mississippi taxpayers can contribute up to $1,000,000. These contributions will not only make a tremendous difference in the lives of the children we serve but will also bring considerable financial advantages for those who contribute:

BUSINESSES

Credit can be used against:

• income tax (50% tax liability) insurance premium tax (50% of tax liability)

• insurance premium retaliatory tax (50% of tax liability)

• ad valorem tax (50% of real property tax liability)

INDIVIDUALS

Credit can be used against

• income tax (50% tax liability)

• ad valorem tax (50% of real property tax liability)

Children’s Promise Tax Credit (QCO)

*A limited number of individual tax credits are still available for 2025

Receive a credit up to $2,400 for married couples filing jointly, or $1,200 for single filers.

Began: January 2, 2025 at 8:00 a.m. CST

Should you require any additional information, please do not hesitate to contact our team at 769-456-7021 or smciver@homesofhope.ms. We sincerely appreciate your consideration of making a lasting impact on the lives of the kids at Homes of Hope for Children.